December 16th, 2018

The upside of predicting a downturn in the economy is that eventually you’ll be right. The downside is that while the party’s still in full swing you’re just the grouchy guy in the corner, scowling at the other guests.

I’ve been calling for the current stock market sell-off for a couple of years now, and if you’d listened to me you would have missed out on at least a 20% plus gain in your investment portfolio. But this market “correction” is surely overdue: there’s only so long that people are willing to pay $225/share for a company that makes overpriced cameras masking as smartphones (or is it overpriced smartphones pretending to be cameras?) before somebody blinks, or some bad news pops. Apple shares are down 30% from their recent October peak; the much-lauded trillion-dollar-plus company is now worth roughly $800 billion. (September 12, 2019: Back to a trillion. August 19, 2020: Two trillion.)

So are stocks a bargain right now, or, if you sell this week could you be protecting yourself from a further drop of 10 or 20 or 30 per cent? It’s your call.

The stock market isn’t necessarily a proxy for the broader economy. Stock markets often move independently of other economic trends. It just that the current market swings are the broadest we’ve seen in a while, which got me thinking about where the economy is headed. At what point does the economy blink the way the stock market is blinking? In other words, when does the broader economy return to a recessionary state, last seen a decade ago, and how will that impact the publishing industries that I follow on this blog.

Yesterday Today?

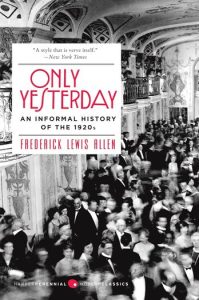

I’ve been re-reading Frederick Lewis Allen’s excellent Only Yesterday: An Informal History of the 1920s. Published in 1931, just after the events described, Allen’s insightful book reads as if he had the benefit of years of hindsight in preparing his account of a decade “when dizzying highs were quickly succeeded by heartbreaking lows.” It’s particularly fascinating to be reminded that the stock market crash of 1929 was preceded by numerous ups and downs of the indices, often just days apart.

I’ve been re-reading Frederick Lewis Allen’s excellent Only Yesterday: An Informal History of the 1920s. Published in 1931, just after the events described, Allen’s insightful book reads as if he had the benefit of years of hindsight in preparing his account of a decade “when dizzying highs were quickly succeeded by heartbreaking lows.” It’s particularly fascinating to be reminded that the stock market crash of 1929 was preceded by numerous ups and downs of the indices, often just days apart.

In this decade some 90 years later we’ve been enjoying the dizzying highs, yet few lows. How much heartbreak are we facing in the next round? Or maybe things will be OK; it could be just a blip. Maybe this time it’s different.

Warning Signs

Call me a contrarian: I collect bad reviews of the economy. I’ve got a folder called “Next Recession” nested in a broader basket I call “Current Economics.” Fifty clippings are contained within, with titles like “Another Economic Downturn is Just a Matter of Time” and “Here’s What Could Make the Next Global Recession Even Worse.” Many date back to mid-2017. Those are nearly all optimistic, stating that a recession is nowhere in sight. In early 2018 the forecasts remained sanguine, most predicting that we’re in the clear at least into 2020. In a May roundup of economists by the Wall Street Journal the consensus was also for 2020, with nearly a quarter of the group looking out to 2021. John Mauldin’s May survey of “seven smart market thinkers” suggested less optimism, with an average prediction for recession in the second half of 2019. But an October article on CNN puts the recession two years out, to the summer of 2020.

The 2019 Duke University/CFO Global Business Outlook December survey of the folks holding the corporate purse-strings tallied half of CFOs expecting a recession by end of next year. Of course predictions like this can be self-fulfilling: as Peter Boockvar points out, “While the CFO’s surveyed could be very wrong in their predictions, for the sole reason that they think there is a good chance of recession coming, they will act accordingly, aka, more conservatively.” (The 2020 survey is headlined “CFOs Optimistic but Uncertain About the Pace of Recovery.”)

A FoxBusiness story published December 17, 2018 was headlined “Why the US economy will likely fall into a recession next year.” It features an interview with the chief investment strategist at Charles Schwab who actually doesn’t think we face an economic recession next year.

So there you have it. The next recession is due some time next year or the year after that or maybe in 2021.

It’s your call.

• • • • • • • •

Why am I bothering with this exercise in recession-mongering? Here’s my use case: even if the next downturn is two years away, publishers should be putting contingency plans in place now. Things could get ugly. (Postscript: Of course none of this took Covid-19 into account.)

In my next blog entry I’ll look at the historic impact of recessions on the varied publishing industries. Recession-proof? We’ll see.

Some additional recession-related predictions/analysis published after this blog post:

- The chance of recession in the next 12 months rose to 23 percent in the CNBC Fed Survey (CNBC).

- How Close are We to The Start of the Next Recession? (Seeking Alpha)

- Next US recession will be ‘much worse’ than the last: Euro Pacific Capital CEO Peter Schiff (FOXBusiness).

- Why are markets falling, and are we heading for global recession? (The Guardian).

- As Markets Tumble, Tech Stocks Hit a Rare and Ominous Milestone (New York Times)

- Several important points in this article:

- “The tech-heavy Nasdaq… has officially entered a bear market.”

- “Bear markets in stocks are rare but have the power to spread gloom through the economy.”

- “The stock market is still well above where it was even at the start of 2017.”

- Several important points in this article:

- Bloomberg, December 30, 2018: “U.S. Stocks End Worst Year Since Financial Crisis.” But there’s been a solid bounceback in the last week. Could this be (using my all-time favorite stock market term) a Dead Cat Bounce?

- January 3, 2019: Chinese Consumers’ Confidence Sags, Casting a Pall Over the Global Economy (NYT)

- January 3, 2019: Delta Spurs Plunge Among Airlines After Cut to Revenue Forecast (Bloomberg).

- January 4: A generally optimistic forecast from the World Economic Forum.

- January 5: A very good overview from The Economist: Whoosh: What the market turmoil means for 2019

- January 7: The Wall Street Journal thinks “Signs Point to Strong January for Stocks” while

- January 8: The Guardian reports “Analysts: Recession risks have increased” with one analyst suggesting that “The German economy has likely hit a (technical) recession.”

- January 10: The Wall Street Journal again: “Economists See U.S. Recession Risk Rising.”

- January 15: 9to5Mac.com: “Chief economist says AAPL (Apple’s) share price predicts a trade recession in China.”

- January 20: New York Times: “Three straight weeks of gains in the new year on Wall Street have erased nearly all of 2018’s losses. It’s the best start to a year since 1987.”

- January 22: New York Times: “Stocks Sink on Growth Fears and Possible Snag in Trade Talks.”

- January 22: The Economist: “The euro area is back on the brink of recession.”

- January 25: Paul Krugman in the New York Times: “The conditions for such a slump are now in place, in a way they weren’t even a few months ago.”

- February 24, 2019: Wall Street Journal: “Resurgence in Cyclical Stocks Pushes Dow Industrials Toward New High”

- February 24: Bloomberg: “How to Identify a Bear Market Rally”

- February 28, Observer: “Hedge Fund Legend Ray Dalio Is Changing His Mind About the Next Recession” Quote: :Dalio said he’d lowered his odds of a recession by 2020 to 35 percent [from 70 percent].”

- March 17, WSJ: “Stocks and commodities are on the verge of rallying to highs that have eluded them during recent upswings, a breakthrough that investors say would likely fuel further gains.”

- March 22, NYT: “Stocks Fall as Bond Market Flashes a Recession Warning… It’s one of Wall Street’s favored predictors of a recession, and it happened on Friday.”

- April 9, Bloomberg: “Guggenheim Says Chance of Recession in 24 Months Has Doubled”

- April 10, CNBC: “Goldman Sachs says chance of a recession is now just 10%”

- April 16, Harvard Business Review: “How to Survive a Recession and Thrive Afterward”

- Apr 18, Marketwatch: In the latest edition of the Duke survey described above, CFOs are not as pessimistic as they were three months ago, although “the recession predictions are closer than usual, with a greater magnitude.”

- April 24, New York Times: “The Stock Markets Hit a Record High”

- April 27, 2019: The Economist: “Rising oil prices could prevent a world economic rebound: the risk of an oil-price shock is increasing.”

- May 3, New York Times: “U.S. Added 263,000 Jobs in April…the unemployment rate was 3.6 percent, the lowest in half a century… a fresh sign that the recent fears of a slowdown were overblown.”

- May 9, New York Times: “Stock Market Rout Extends to Fourth Day as U.S. Prepares to Raise China Tariffs.”

- May 13: Financial Times: “US stocks fall sharply as US-China trade war escalates.”

- May 14: MarketWatch: “Stocks close higher as market regains bullish form in wake of trade-sparked rout.”

- May 15: Wall Street Journal: “U.S. Economy Lost Some Steam at Start of Second Quarter: Retail sales and factory output declined in April, data show”

- May 23, 2019: Wall Street Journal: “Stocks, Bond Yields Fall Amid Flare-Up in Trade Tensions.”

- May 23: The Economist: “The joys and pains of investing in a mature business cycle: Investors fear that a recession cannot be far off.”

- May 28: Wall Street Journal: “Global Bond Yields Fall Near Multiyear Lows: Investors increasingly concerned the long post-crisis expansion could be nearing an end.”

- June 5: Wall Street Journal: U.S. Crude Oil Enters Bear Market Due to Global-Growth Fears.

- June 5: The Globe & Mail: “U.S. stock market still an accident waiting to happen.” Quoting from a Capital Economics report.

- June 7: Reuters: “The weakness of retail sector numbers stood out in a monthly U.S. employment report that fell well short of expectations overall…”

- June 15, 2019: Business Insider: “Trump warns of a ‘market crash the likes of which has not been seen before’ if he loses 2020 election.”

- June 18: New York Times: “Global Economic Growth Is Already Slowing. The U.S. Trade War Is Making It Worse.”

- June 18: WSJ: “Stocks Surge After Trump Says He Talked With Xi.”

- June 20: New York Times: “Stocks hit a record high a day after the Federal Reserve opened the door to interest rate cuts.”

- June 29, 2019: The Economist: “The global economy is on a knife-edge… the mood has taken to whipsawing between gloom and optimism.”

- July 1, 2019: New York Times: “Stocks rose on Wall Street, following global markets, as investors were buoyed by a thaw between the U.S. and China.”

- July 1, 2019: New York Times: “Consumers Are Spending. Businesses Aren’t. Who’s Right About the Future?”

- July 1, 2019: New York Times: “America’s economic expansion became the longest on record today.”

- July 13, 2019: The Economist: “As these years of growth have dragged on, it has become increasingly easy to find people sure they will soon come to an end. And yet they have not.”

- July 29, 2019: New York Times: “A Recession Is Coming (Eventually). Here’s Where You’ll See It First.”

- July 31: Wall Street Journal: “Fed Cuts Rates; Stocks Fall As Powell Signals Caution.”

- August 12, 2019: Reuters: “Wall Street falls on geopolitical tensions, recession fears.”

- August 13: New York Times: “U.S. to Delay Some China Tariffs; Markets Soar.”

- August 14: Wall Street Journal: “Stocks Skid as Bonds Flash a Warning… the drops erased optimism of a day earlier…”

- August 14: New York Times: “Deutsche Bank analysts predicted that the (German) economy would continue to shrink in the current quarter, meeting the technical definition of a recession.”

- August 19: Wall Street Journal: “An Economic Warning Sign: RV Sales Are Slipping…The RV industry is better at calling recessions than economists are.”

- September 1, 2019: New York Times: “A decade of historically low interest rates has begun to warp our economy.”

- September 4, 2019: New York Times: “A Recession Isn’t Inevitable: The Case for Economic Optimism.”

- September 13: AP: “The U.S. economy is sending some worrying signals about a possible recession, yet the stock market has gone on a what-me-worry ride toward record heights.”

- September 15: Wall Street Journal: “Resilient U.S. Growth Propels Stocks as Trade Fears Ease.”

- September 24: Wall Street Journal: “Renewed Growth Fears Push Down Stocks, Ending Recent Lull.

- October 7, 2019: Associated Press: “Business Economists Foresee Slowdown in US Growth… a sharp slowdown in economic growth this year and next, raising concerns about a possible recession starting late next year.”

- October 21: The Guardian: “World economy is sleepwalking into a new financial crisis…”

- October 25: Paul Krugman in the New York Times: “…while there will eventually be a nationwide recession — the business cycle has not been abolished — it’s not at all clear that we’ll have one before next year’s election.”

- November 5: Wall Street Journal: “Investors’ Multitrillion Dollar Cash Hoard Could Push Stocks Higher.”

- November 8, 2019: New York Times: “Recession fears are receding. That doesn’t mean they were unfounded.”

- November 17: Wall Street Journal: “Stocks’ latest records are a testament to one thing: Investors aren’t worried about a recession happening soon.”

- November 19, Financial Times: “Is the global economy about to rebound?… The IMF and other forecasters expect 2020 to be better than 2019…”

- December 6: Wall Street Journal: “Strong U.S. Hiring Eases Concerns About Economy”

- December 12, 2019: New York Times: A Recession Hasn’t Arrived (Yet). Here’s Where You’ll See It First.

- December 21, 2019: Slate: “Why Everybody Stopped Worrying About a Recession.”

- December 31, 2019: CNBC: “Don’t look now, but Goldman Sachs is saying the economy is nearly recession-proof”

- January 2, 2020: The Financial Times: “The US economy is not recession-proof”

- January 10, 2020: Wall Street Journal: “Dow Industrials Pull Back After Crossing 29,000 for First Time” (But re-crossed 29,000 on January 15, and continued rising.)

- January 11, 2020: The Economist: “Monetary policy will not be enough to fight the next recession.” The same issue reports a prediction that the chance of a recession in 2020 at only 20%.

- January 17, 2020: Barron’s: “The Method Behind the Melt-up: Why the Dow Won’t Stop at 30,000”

- January 28, 2020: Reuters: “Services in spotlight after Apple stock market value hits $1.4 trillion.”

- January 31, 2020: WSJ: “Dow Drops 600 Points on Global Growth Concerns”

- February 4, 2020: WSJ: “Stocks Climb as Investors Bet on Economic Resilience”

- February 15, 2020: New York Times: “Will the Coronavirus Cause a Recession?”

- February 18, 2020: South China Morning Post: “Luck may be the only thing standing between the coronavirus and a US stock market crash”

- February 20, 2020: The Economist: “Business and the next recession: When economies change, so do recessions. What will the next one look like?”

- February 25, 2020: New York Times: “Wall Street Is (Finally) Waking Up to the Damage Coronavirus Could Do.”

- February 27, 2020: WSJ: “U.S. Stocks Slide Into a Correction as Virus Fears Show No Sign of Easing”

- March 3, 2020: Reuters: “the U.S. Federal Reserve cut interest rates on Tuesday in an emergency move to try to prevent a global recession…”

- March 3, 2020: New York Times: “Fed Makes Emergency Rate Cut, but Markets Continue Tumbling.”

- March 4, 2020: Business Insider: “Dow surges 1,173 points (4.5%) after Congress agrees on emergency spending bill, Biden dominates Super Tuesday”

- March 5, 2020: New York Times: “Markets nose-dived again as virus outbreaks multiplied worldwide.”

- March 5 Edition: The Economist: “A recession is unlikely but not impossible.”

- March 6, 2020: Reuters: “Coronavirus infects more than 100,000 worldwide, wreaking financial havoc.”

- March 9, 2020: New York Times: “Wall Street, Rattled by Coronavirus, Has Worst Day in Over a Decade.”

- March 10, 2020: WSJ: “Stocks Soar in Turbulent Trading a Day After Bruising Selloff.”

- March 11, 2020: New York Times: “Dow Ends 11-Year Bull Market as Coronavirus Defies Imperils Economy.”

- March 12, 2020: WSJ: “Stocks Plunge 10% in Dow’s Worst Day Since 1987.”

- March 13, 2020: Reuters: “Stocks stage furious rally late after national emergency declared.”

- March 13, 2020: New York Times: “How to Stop Worrying and Love a Falling Stock Market.”

- March 16, 2020: New York Times: “…Even the most optimistic economists are forecasting a recession.”

- March 16, 2020: New York Times: “Markets Plunge as a Global Recession Appears Almost Inevitable.”

- March 17, 2020: Reuters: “Wall Street rebounds from Monday’s crash as Fed boosts liquidity.”

- March 17, 2020: New York Times: “White House Seeks $850 Billion Stimulus and Urges Sending Checks to Americans Within 2 Weeks”

- March 17, 2020: U.S. News & World Report: “The U.S. economy is in a recession.” Gregory Daco, chief U.S. economist at Oxford Economics

- March 18, 2020: New York Times: “Do Recessions Always Follow Major Stock Market Downturns? Usually.”

- March 21, 2020: New York Times: “…there is little doubt that the nation is headed into a recession… But it is harder to foresee the bottom and how long it will take to climb back.”

- March 24, 2020: Reuters: “Dow soars over 11% in strongest one-day performance since 1933.”

- March 26, 2020: New York Times: “Markets Shrug Off Jobless Claims as S&P Has Best 3-Day Run Since 1933.”

- March 31, 2020: Marketwatch: “Stocks end lower as Dow suffers biggest quarterly loss since 1987.”

- March 31, 2020: The Washington Post: “Dow caps worst first quarter of its 135-year history by sliding more than 400 points.”

- April 6, 2020: WSJ: “JPMorgan CEO James Dimon Says He Is Expecting ‘a Bad Recession’”

- April 6, 2020: Washington Post: “Wall Street stages explosive rally, powering Dow nearly 1,600 points as investors seize on morsels of good news.”

- April 10, 2020: New York Times: “Everything Is Awful. So Why Is the Stock Market Booming?”

- April 17, 2020: WSJ: “Stocks and the Economy Send Very Different Messages.”

- April 21, 2020: New York Times: “Mayhem in oil markets drags Wall Street lower.”

- April 22, 2020: New York Times: “Global markets rise as investor sentiment improves.”

- April 17, 2020: WSJ: “Coronavirus Projected to Trigger Worst Economic Downturn Since 1940s.”

- April 26, 2020: WSJ: “Markets Diverge in Assessing the Economic Freeze.”

- April 30, 2020: New York Times: “U.S. Stocks Have Their Best Month Since 1987: The news is terrible but Wall Street had its best month in decades.”

- May 8, 2020: WSJ: “Why Is the Stock Market Rallying When the Economy Is So Bad?”

- May 27, 2020: New York Times: “Investors keep pushing stocks higher.”

- June 5: Reuters: “Wall Street jumps, Nasdaq set for record closing high after surprise jobs report.”

- June 8, 2020: WSJ: “S&P 500 Rebounds to Close in Positive Territory for the Year.” (Next headline “Recession in U.S. Began in February, Official Arbiter Says.”)

- June 22, 2020: Wolf Street: “I, Who Hates Shorting, Just Shorted the Entire Stock Market. Here’s Why.”

- July 19, 2020: WSJ: “Don’t Worry About the Tesla Bubble. The Market Has Other Issues.”

- August 17, 2020: WSJ: “S&P 500 Finishes Just Shy of Record.”

- August 19, 2020: Washington Post: “Rising stock market would be in the red without a handful of familiar names.”

- August 18, 2020: New York Times: “S&P 500 hits a record as traders look past economic devastation.”

- September 2, 2020: WSJ: “Dow Rallies Above 29000; S&P 500, Nasdaq Hit Fresh Records.”

- September 3, 2020: WSJ: “U.S. Stocks Fall Amid Decline in Tech Shares.”

- September 21, 2020: WSJ: “Stock Losses Accelerate; Dow Drops More Than 600 Points.”

- October 9, 2020: WSJ: “Stocks Close Higher to Finish Best Week in Three Months.”

- October 28, 2020: WSJ: “Stocks Close Sharply Lower on Rising Coronavirus Cases.”

- October 30, 2020: New York Times: “Stocks Suffer Biggest Weekly Decline Since March as Virus Spreads.”

- October 31, 2020: WSJ: “…U.S. stock indexes wrapped up their worst week since the March sell-off, amid jitters over next week’s U.S. presidential election.”

- November 5, 2020: USA Today: “Dow on track for best week since April as election rally gains steam.”

- November 9, 2020: WSJ: “Dow Surges to Highest Level Since February on Vaccine Results, Biden Win.”

- November 16, 2020: CNN: “Dow and S&P 500 hit new record highs after Moderna says vaccine is 94.5% effective.”

- November 19, 2020: The Globe & Mail: “BMO predicts big gains ahead for the TSX and S&P 500.” (“…a year-end S&P 500 target of 4,200 — a more than 17% rise from current levels.”)

- November 24, 2020: WSJ: “Dow Industrials Hit 30000 Milestone.”

- November 24, 2020: WSJ: “Behind Dow 30000: A Self-Perpetuating Upward Spiral: Low interest rates and a buy-the-dip mantra have put stocks in an ascending pattern, defying the pandemic and economic woes.”

- December 16, 2020: The Economist: “Froth or fundamentals? What explains investors’ enthusiasm for risky assets? There may be more sense to recent market movements than you think

- December 26, 2020: New York Times: “Market Edges Toward Euphoria, Despite Pandemic’s Toll.”

- December 31, 2020: Washington Post: “The stock market is ending 2020 at record highs, even as the virus surges and millions go hungry.”

- January 4, 2021: WSJ: “U.S. Stocks Slide to Start 2021: S&P 500, Dow fall after both benchmarks closed at records on last day of 2020.”

- January 5, 2021: GMO, Jeremy Grantham: “Waiting for the Last Dance: The Hazards of Asset Allocation in a Late-stage Major Bubble.”

- January 24: Financial Times: “Investor anxiety mounts over prospect of stock market ‘bubble’.”

- January 25, 2021: WSJ: “If It Looks Like a Bubble and Swims Like a Bubble… Several parallels between the dot-com bubble and today’s stock market are strong.”

- January 25, 2021: New York Times: “How Options Trading Could Be Fueling a Stock Market Bubble.”

- February 13, Financial Times: “Investors pour record $58bn into global stock funds in single week.”

- March 3, 2021: New York Times: “Jittery Stocks, Jumpy Bonds: Why Investors Are Troubled by Signs of Growth.”

- March 4, 2021: WSJ: “Stock Selloff Accelerates After Powell’s Comments.”

- March 7, 2021: Pairagraph: “A Speculative Market on Steroids?”

- April 7, 2021: WSJ: “Investors Big and Small Are Driving Stock Gains With Borrowed Money.”

- April 11, 2021: New York Times: “Fed Chief Says U.S. Economy Is at an ‘Inflection Point’ as Risks Remain.”

- April 15, 2021: WSJ: “Dow Passes 34000 on Strong Earnings, Economic Data.”

- April 23, 2021: New York Times: “Housing Market in Frenzy Like No Other Since 2008.”

- May 5, 2021: WSJ: “Everything Screams Inflation: Investors are woefully unprepared for what may be a once-in-a-generation shift in the market.”

- May 11, 2021: WSJ: “Stocks Fall as Dow Posts Worst Day Since February.”

- May 12, 2021: WSJ: “Stocks Extend Slide on Inflation Data: The Dow and S&P 500 finish their steepest three-day declines in nearly seven months.”

- June 11, 2021, WSJ: “S&P 500 Sets New High, Rises for Third Straight Week.”

- June 15, 2021: New York Times: “The Fed Cannot Control Its Easy-Money Monster.”

- June 18, 2021, WSJ: “Dow Falls More Than 500 Points: Stocks drop after Fed official James Bullard said he expects the first rate increase in late 2022.”

- June 21, 2021, WSJ: “Stocks Rebound as Dow Gains More Than 550 Points: Investors assess the prospects of higher economic growth, inflation and rising interest rates.”

- June 30, 2021, Financial Times: “Investors still diving into US equities with valuations at record highs: Money is pouring into the US stock market at fastest pace since 2015.”

- July 19, 2021: WSJ: “Virus Worries Ripple Through Markets.”

- July 31, 2021, Financial Times: “Is the world facing an inventory recession?: Demand for goods might drop after stockpiles are run down as supply chain problems ease.”

- September 2, 2021: WSJ: “Speak No Evil of the S&P 500’s Neverending Records: Investors buying stocks no matter what shouldn’t fool themselves that the future will deliver the chunky returns of the past decade”

- September 16, 2021: CNBC: “The stock market is undergoing a slow motion deterioration with pockets of shares down 20% or more.”

- September 23, 2021: The Street: “Stocks May Drop 20% as Stimulus Eases, Growth Slows: Morgan Stanley”

- September 23, 2021: New York Times: “Global Markets Swoon as Worries Mount Over Superpowers’ Plans.”

- September 23, 2021: WSJ: “Stocks Jump as Market Turns Positive for the Week.”

- September 28, 2021: NYT: “Stocks tumble in worst day since May, as tech shares slide and bond yields climb.”

- October 8, 2021: Globe & Mail: “Bank of England warns stock and bond markets could face sharp correction.”

- November 26, 2021: WSJ: “Stocks, Oil Drop Sharply on Concerns Over New Covid-19 Variant.”

- December 6, 2021: WSJ: “Stocks and Oil Rally on Hopes of Milder Covid-19 Variant.”

- January 21, 2022: NYT: “Wall Street Has Its Worst Week Since March 2020.”

- July 28, 2022: WSJ: “Recession Fears Loom as U.S. Economy Contracts Again

GDP fell at 0.9% annual rate; second straight drop meets a common definition of recession.”

So, I wrote this in mid-December 2018 and it’s late July 2022. I sure know how to call ’em!

November 8, 2022: Bloomberg: “A Recession Suddenly Looks Like It Can Be Avoided.”

But then again, November 19, 2022 in the WSJ: “Stocks Fall, Pressured by Mounting Recession Concerns.”

And on December 30, 2022, via WSJ, “U.S. Stocks Close Out Worst Year Since 2008: Investors are on edge about how 2023 will shake out.”

March 27, 2024: It has become ludicrous. Both the hot economy, and my utter failure as a financial prognosticator. In today’s WSJ, after stocks once again smashed records, “The S&P 500 Is Poised for Best Start to Year Since 2019: Resilient corporate profits, enthusiasm around AI and hopes that the Fed will cut rates have given investors plenty of reasons to keep on buying.”

August 5, 2024: New York Times: “U.S. Stock Market Sees Biggest Daily Drop in Nearly 2 Years.”