July 16th, 2010

The Wall Street Journal is good with the facts, but it’s easy to find the bias in its reporting. Only through the filter of the Western world’s most widely circulated financial newspaper do you have to parse a headline that states:

Economists Express More Optimism

…when the summary text states: “Economists surveyed by The Wall Street Journal are more optimistic about the direction of the economy than the general public, though they are revising down forecasts for growth and jobs.” [All emphasis added in this piece is/are mine.]

On the face of it the contradiction is obvious. The actual article provides some facts against which we can judge the summary (there’s much more about “the facts” in my postscript below):

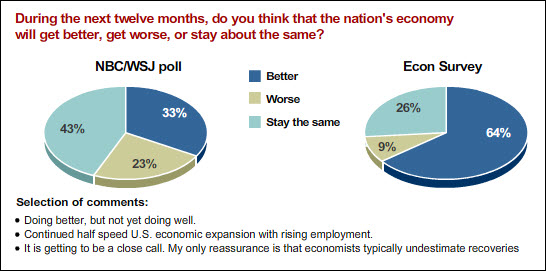

The majority (64%) of the 55 economists polled—not all of whom answer every question—said that the economy would get better over the next 12 months and 9% said it would get worse; the rest said it would stay about the same. In contrast, the latest WSJ/NBC News poll found 33% of the general public expected the economy to improve and 23% think it will get worse.

The difference may depend on the definition of “better.” The economy is “doing better, but not yet doing well,” said Neal Soss of Credit Suisse. Economists, on average, now see the odds of double-dip recession at 20%. On average they expect the economy to grow at a pace below 3% through the second quarter of 2011, so slow that they anticipate the unemployment rate, now at 9.5%, will drop to just 8.6% by the end of 2011.

The broad public is implicitly wrong; the 55 selected economists are implicitly right; and “the difference may depend on the definition of ‘better.'” Indeed.

The headline they could write for this story is Economists and Public Split in their Opinion of the Economy (but Sometimes Agree with Each Other) as it continues:

The economists and public were in line on their views of President Barack Obama’s handling of the economy. Half the respondents to the WSJ/NBC poll disapprove of it; 46% approve. Among the economists, 29 or 64% of those who answered the question disapprove. And similar majorities of the public (63%) and the economists (70%) agree that Congress should focus on reducing the budget deficit even if it means it will take longer for the economy to recover.

So even though economists think it’s going to improve, the reason it will improve is because of a policy they disapprove of; 70% of the economists would be happy to slow down the improvement by deliberate short-term government policy.

“The public” becomes the straw man for this story, something to define the economists against. The two polls were taken independently, nearly a month apart. “The public” was represented by 1000 adults who presumably believe that “your opinion is important to us” (22% are retired). They were asked qualitative questions, i.e. “During the next twelve months, do you think that the nation’s economy will get better, get worse, or stay about the same?” The 55 economists were asked for numeric forecasts for GDP, CPI, unemployment, housing starts and prices, and crude oil prices, by quarter, for the next year. They were also asked a dozen specific questions, four of which matched those asked in the public poll.

Paul Krugman, the economist and columnist for The New York Times, who won the 2008 Nobel Prize in Economics, disagrees with the 70%: “I and others have watched, with amazement and horror, the emergence of a consensus in policy circles in favor of immediate fiscal austerity.” For broad background read his excellent article: “How Did Economists Get It So Wrong?”

What does this suggest for the future of publishing? One way or another, the economy will not offer much succor for several seasons. Growth in media in the West will come despite the economy, not because of it. Apple innovates with the iPad and succeeds in a down economy while advertising sales remain sluggish. (Google reported Thursday that it can’t get them up much either, while its innovations have yet to “move the needle.”)

And economics will continue to earn its sobriquet “the dismal science.”

PS: I want to acknowledge one aspect of the overall process used by The Wall Street Journal in developing its coverage of this story. Even non-subscribers can download the original data used for its reporting (although the xls-format document provides only aggregate numbers on the qualitative answers from the economists and you have to hunt for the public survey). You can also download previous forecasts, and chuckle when they miss the mark by a mile, or marvel when they’re on the money.

My credo for this site is: Write what you will, but always try to provide the source material used to form your judgment. Readers in return have the option for an informed assessment of your opinion rather than the worthless nattering that passes for commentary on most websites.

And so kudos to the WSJ. By examining all of the data offered, and gathering some extra (all of it referenced and linked) I’ve formed my judgment.

I pointed out above some apples and oranges aspects of the two surveys. Here are a few more:

1. A World of Contradictions

The group of economists described above weighed in at 50/50 on the financial regulation legislation passed Thursday. According to the WSJ: “Economists surveyed by The Wall Street Journal this week were evenly split on whether they would have voted for the financial regulatory bill that passed the Senate Thursday. Of those surveyed, 21 said they would vote yes; 22, no.” (Neither the report nor the spreadsheet reveal what the other ten respondents said: it’s not clear whether all 55 answered the qualitative questions or just the numeric ones.)

The WSJ employs Karl Rove to write a weekly rant against Obama and the Democrats (I doubt that was in the job description, but it’s what he delivers, ad nauseum). I’m sure it sells papers, but I find the content, regardless of bias, to be just embarrassingly badly formulated and written. At the same time, his bias is so obvious that the writing bears no semblance of the credibility that comes with balance. Today’s column is titled “My Biggest Mistake in the White House.” I enjoyed a brief moment imagining he possessed the ability to admit failure. Well, he does. What was his failure? “Failing to refute charges that Bush lied us into war” when “we know President Bush did not intentionally mislead the nation.”

My roundabout point is that the economists working with The Wall Street Journal inhabit a different world than “the public.” Most of them work for large financial institutions, including Morgan Stanley, BofA Merrill Lynch, Goldman Sachs, J.P. Morgan, Deutsche Bank, Moody’s, Barclays Capital, Wells Fargo, and Credit Suisse. Why would anyone compare the opinions of this group to Joe Q. Public?

I looked closely at several of the quantitative answers provided by the economists and compared those to the key qualitative response to the question “During the next twelve months, do you think that the nation’s economy will get better, get worse, or stay about the same?” As reported, the qualitative answer was 64% better, 9% worse, 26% stay about the same.

As noted above the journalist Phil Izzo explained, “The difference may depend on the definition of ‘better.'” Apparently it’s not just GDP, as 40% of the economists believe that it will be smaller at the end of 2011 than at the end of this year (9% think it will be the same). Perhaps it’s unemployment, where all but one economist sees the percentage dropping by end of next year (although from a bleak 9.4% to a less-bleak 8.6%). Nearly 6 out of 10 see consumer prices rising, not generally a good thing. All but one of the 44 who ventured to predict housing prices sees an increase next year; the one who thinks they’ll hold steady next year believes the improvement will happen this. Economists and homeowners can crack a half-smile; renters (a third of the population) a frown. Still the predicted improvement is less than 2% for prices that, according to the latest S&P/Case-Shiller Home Price Indices report, are currently running at 2003 levels.

The Wall Street Journal, so central to this entry, also reported separately today that “weak industrial output and a drop in wholesale prices point to a slowing in the economic recovery.” It’s a world of contradictions.

2. The Bias of Economists

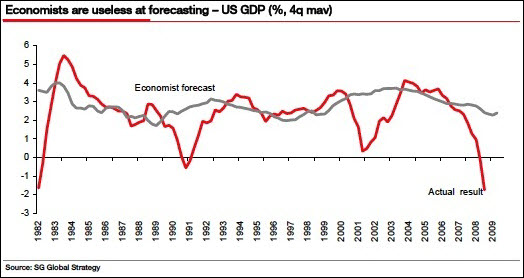

I hope it will not shock you to read that just because someone has a Ph.D. that he or she might still be biased. There is ample documentation of the bias of economists (see #7 in this article; spend some time on the background provided). Here’s an example of something they’re not so good at:

3. “The Economists” vs. “The Public”

The public survey positioned by The Wall Street Journal in opposition to the 55 economists was a telephone survey of 1000 adults, conducted June 17-21, 2010. I ran the basic survey demographics against the Census department figures for the U.S. population, and the survey contractor appears to have done a good job finding an acceptably close demographic match on basic attributes like age, race, education and household income. This serves to highlight that the demographics of the economists participating in the WSJ’s survey are remote from those of the general public. For example:

(i) There are slightly more women than men in the U.S.

The economists: 53 male; 2 female.

(ii) 38% of the population is age 18-44. I didn’t check everyone on the list of economists, but of those I checked, one appeared possibly to be younger than 44. Most are much older. I doubt that 5% of the group of 55 are between 18 and 44 years old.

(iii) Some 60% of the survey respondents lack even a bachelor’s degree. All of the economists have postgraduate degrees.

(iv) About 80% of U.S. households have incomes below $100,000 per year. About 100% of the economists have household incomes above $100,000 per year.

(v) 47% of the public survey respondents did not “know enough to say” what they thought of the nomination of Elena Kagan to the Supreme Court. The economists were not asked this question, but we can imagine that few would admit that they didn’t know enough to express an opinion on this important current issue.

(vi) CBS News conducted a similar public poll to the NBC/WSJ poll, except the CBS poll ran July 9-12, a month later than the competition. Many of the questions were similar; so too the answers. The major difference is that CBS probed more deeply into the economic circumstances of respondents. Both surveys found nearly 60% of respondents employed. CBS found 14% of its respondents “temporarily out of work”; NBC/WSJ only 7% “unemployed, looking for work.” It gets worse.

In the CBS poll over a third rated “the financial situation in (their) household these days” as “fairly” or “very bad.” A quarter suggest that the situation is deteriorating. 60% are “somewhat” or “very concerned” that someone in their household might be out of work in the next year. Almost a third of the employed had seen their income reduced in the past year “as a result of economic conditions.” Those same conditions drove 44% to take money out of a “savings account, including retirement savings” during the past year “in order to make ends meet.”

And these people are supposed to be optimistic about the economic future? That 25% felt the economy “is getting better” seems a tribute to Yankee optimism. When 48% think the economy is “staying about the same” that means they think it’s staying crummy.

I wonder how the WSJ economist’s panel would respond to these same personal issues.

(vii) Finally, if you ask an economist a question like “During the next twelve months, do you think that the nation’s economy will get better, get worse, or stay about the same?” the economist, by nature of his or her training and profession, will perceive the question, per se, very differently than a member of the public. If the economist foresees even a 2-3% improvement, the honest and professional answer is “yes”. For Joe Q, 3% is imperceptible, not within focal range.

More to the point, the journalists at the WSJ are surely familiar with the famous 1996 study I note in my economic bias sources that examined public perception of economic issues, versus statistical facts. As The Washington Post commented at the time:

Yet here are the public’s bleak perceptions: The average American thinks the number of jobless is four times higher than it actually is. Nearly 1 in 4 believes the current unemployment rate tops 25 percent — the proportion of Americans who were estimated to be out of work at the worst of the Great Depression. They believe that prices are rising four times faster than they really are and that the federal budget deficit is higher, not lower, than it was five years ago. And 7 in 10 say there are fewer jobs than there were five years ago.

This wide gap between economic perception and reality helps explain the wary public mood this election year. The economy is growing and statistics show that the average American is benefiting in many measurable ways. Yet many people don’t see these gains reflected in their lives. Instead, they’re looking anxiously at friends and neighbors who aren’t sharing in the gains — and worrying about an economy that appears much harsher to them than the facts seem to warrant.

These misperceptions, from overestimating the unemployment rate to underestimating gains in family income, cloud and confound the public’s view of the nation’s economy, according to a new survey by The Washington Post, Harvard University and the Henry J. Kaiser Family Foundation.

Some fourteen years later the problem for the lawmakers in Washington remains that at election time the public perception of the economy is more important than the analysis of the economists. Newspapers like The Wall Street Journal fulfil their appointed roll by trying to get the public to see things in the same way as the powers that be. You’re wrong, Joe Q— the experts know better. Elect a Republican in November and your pain will soon be over.